Gold leaf farming sector still searching for own El Dorado

December 3, 2020

THE past five years of the Philippine tobacco industry paint a bleak future: dwindling tobacco area and declining number of farmers. The major culprit? Falling domestic cigarette consumption due to higher excise taxes and anti-smoking initiatives both by the government and the private sector. Despite this, the tobacco industry, which started in the late 16th century, remains among the cornerstones of Philippine agriculture. The crop, also called gold leaf, still brings more than P3 billion worth of value to the agriculture sector annually.

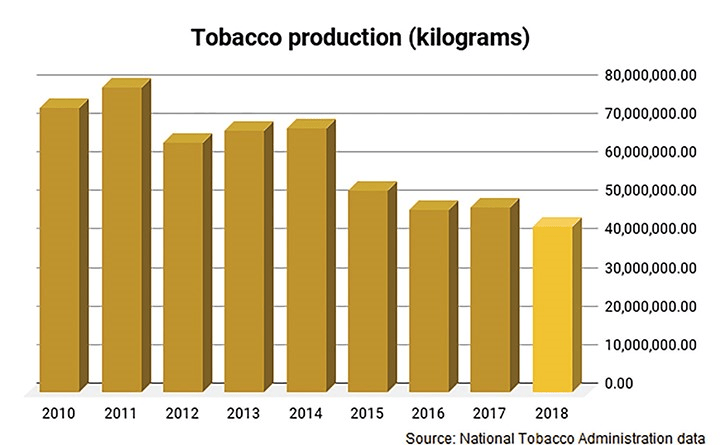

Latest National Tobacco Administration (NTA) data shows that total hectarage planted with tobacco plunged to a decade-low of 18,911 hectares last year. Likewise, the number of tobacco farmers in the country last year fell to its lowest level in 10 years at 29,839 tillers, based on NTA data obtained by the BusinessMirror. Despite these reductions, tobacco production in 2019 recovered to 46.571 million kilograms, halting a 9-year skid of output since 2010, the NTA data showed. The volume was 7.7-percent higher than the 43.241 million kilograms recorded in 2018, which was the lowest output since 2010.

Better adoption

NTA OIC-Deputy Administrator for Operations Roberto R. Bonoan said last year’s production recovery was caused by favorable weather conditions and better adoption of recommended technology by farmers. Bonoan explained to the BusinessMirror that farmers have been receiving farm interventions from the NTA and leaf buyers (like seedlings). They also receive incentives if they follow proper technology applications. These incentives include farm inputs and subsidies, cash assistance, firewood assistance and gas, among others.

Despite these interventions, Bonoan admits that the local tobacco industry still lags behind other countries in terms of productivity due to low adoption of farm machinery that could make farm work easier and more efficient.No less than Agriculture Secretary William D. Dar stated that there is a need to make Filipino tobacco farmers “more competitive.” Dar, who sits as chairman of the NTA governing board, emphasized the need for an industry development plan that would “elevate” the industry’s productivity to be at par of foreign tobacco producers.

“We have to use all available resources to accelerate the modernization and industrialization of the tobacco industry, and see to it that the tobacco farmers will have more income,” Dar said during the NTA’s 33rd anniversary in July when he emphasized the goal of “Masaganang Ani at Mataas na Kita [abundant harvest and high income].”

Industry roadmap

TWO years ago, the NTA started crafting an industry roadmap to chart the future of the tobacco farmers, especially in light of rising sin taxes, declining cigarette consumption and rising number of tobacco alternatives like vaping. The NTA tapped the University of the Asia and the Pacific (UA&P) Center of Food and Agribusiness to conduct an industry study that would be the basis for the roadmap.

By 2018, the study was completed and a tobacco industry roadmap was presented to the various stakeholders of the industry. The NTA noted then that the roadmap would guide the industry toward “improving farmers’ incomes, increasing exports, job creation and crop diversification including alternative farming systems, and provide inputs for the development of the manufacturing industries.”

But a key factor in achieving such goal was the “appropriate and effective use of the Tobacco fund.” The tobacco fund was created by the 56-year-old Republic Act 4155, which seeks to promote the country’s Virginia tobacco industry. The fund comprises half of all the tariffs or taxes on imported leaf tobacco collected and half of the total special taxes on locally-manufactured Virginia type cigarettes.

Zeal in development

AS of the end of 2019, Department of Budget and Management (DBM) documents showed that the tobacco fund stood at P71.86 billion. The DBM document said the fund could increase this year to P80.751 billion and P89.642 billion by next year. However, bulk of the fund remains parked in government coffers due to the lack of a sound and proper program that would convince the DBM to release the funds for the further development of the tobacco industry.

Since 2015, the tobacco fund has been increasing by at least P6 billion to as high as nearly P10 billion. Total taxes and tariffs remitted to the tobacco fund last year reached P9.717 billion. In contrast, government expenditure using the tobacco fund is barely scratching the surface. DBM documents analyzed by the BusinessMirror showed the NTA was only able to use from 2015 to 2019 a measly average of P500 million of the parked money. Last year, the NTA spent only P401.370 million from the tobacco fund; this was only 0.55 percent of the total pool.

“We could hardly get some releases from the tobacco fund unless we submit a comprehensive and sound program,” Bonoan told the BusinessMirror.

Proposed Step

BONOAN says they are keeping their fingers crossed that the proposed 5-year Sustainable Tobacco Enhancement Program (Step) would be approved and would be a “step” in the right direction in tapping the tobacco funds and unlocking the remaining potential of the industry. Bonoan explained that the Step seeks to fast-track the “modernization and industrialization” of the industry. The Step is also now considered as the “new and improved” tobacco industry roadmap aligned with Dar’s paradigm. The proposed Step, which will run from 2021 to 2025, targets to double the net income of tobacco farmers by the 2024-2025 market period from 2019-2020 benchmark through increasing their revenues by double digit growth.

The industry blueprint also seeks to achieve the following:

- Meet leaf buyers’ requirements for quality tobacco,

- Increase marketability of tobacco through technical, financial and marketing support,

- Efficient use of resources or saving in cost of production,

- Diversification towards other high value crops and,

- Modernize or mechanize farm activities.

“The targets are defined based on productivity and income rather than area expansion, because tobacco is mainly market-driven. Industry players rely on demand from international buyers in programming their production. They cannot program expansion beyond what the market absorbs, otherwise they will incur losses,” the NTA said in a program overview provided to the BusinessMirror.

Area of production

THE NTA document added that “the efforts are focused on the institutionalization of farm clustering, along with modernization, industrialization of agriculture, export promotion and infrastructure development, as a key strategy for food security, while enhancing the development of the Philippine tobacco sector.”

The NTA said tobacco block farming would serve as a pillar of the 5-year plan as consolidating or clustering tobacco growers into one large production area would be a more efficient measure to improve their production. Block farms would then receive a series of farm interventions including farm machineries, certified seeds, subsidized fertilizer, pesticides and credit services. The NTA explained that through this program, traditional small-scale tobacco-rice farmers, who at an average own less than a hectare of land, into large commercial food systems or networks.

Production, post-harvest

AT the end of the 5-year plan, tobacco farmers would have “more efficient farm production and post-harvest operations” while having “more efficient marketing and distribution of their produce,” according to the NTA.

“This will make the farmers competitive and resilient, and strong enough to face challenges affecting the tobacco industry,” the NTA, an attached agency of the Department of Agriculture, said.

However, the five-year plan’s ambition comes with a caveat: an annual P7-billion utilization of the Tobacco fund at least over the first three years of the program or P21 billion in total. If the NTA would be able to spend such an amount, Bonoan said then tobacco farmers could be self-sustaining as early as the end of the third year of the program and would not need any additional interventions afterwards.

“If we would be able to get as much as P20 billion per year then it would be better,” Bonoan said, noting that the Tobacco fund continues to accrue revenues from imports and local production.

Engaging in blocks

THE NTA said it will establish two model block farms in each of its eight branch offices nationwide for the initial implementation of the program. A block farm would be formed by consolidating 25 hectares of contiguous tobacco area, which is equivalent to about 50 to 75 farmers per block. Bonoan said they have already identified 16 block farms nationwide, with some even exceeding the 25-hectare minimum requirement. He added that the NTA would assign one technician per block farm to assist in the land consolidation and economies of scale. Some of the block farms are in Vigan, Ilocos Sur; Badoc, Ilocos Norte; Candon, Ilocos Sur; Santa Maria, Ilocos Sur; Alcala, Pangasinan; Quezon, Isabelal and, Tuao, Cagayan.

“With this, distribution and use of farm machinery would be more efficient since farmers would not rent farm machinery individually anymore,” Bonoan said.

The NTA said the interventions that would be provided to the block farms would cover its strategic programs concerning market research and trade developments, accelerated farm services, community research management and cooperative farming operations and agribusiness and institutional development.

“Within the block farm are the component projects and programs for one block farm. Actually, these are our current projects and programs for tobacco-rice production marketing and livelihood programs. The new projects are the farm mechanization and the agribusiness enterprise below the big circle,” it added.

Reach for a goal

CENTER for Food and Agri Business (CFA) of the University of Asia and the Pacific (UA&P) Executive Director Rolando T. Dy said the NTA’s plan to push block farming in tobacco is meritorious. The idea is that a cluster of farmers will coordinate their land preparation and planting.

However, there is a need to have a central nursery and there must be a clear focal person for each block. In the view of UA&P CFA Senior Agribusiness Specialist Marie Annette Galvez-Dacul, the government’s sustainable tobacco program is the “way to go for the industry to be competitive because it brings the best standards in agricultural practices.” Consolidation brings about economies of scale. Briones agreed and said block farming could work for the tobacco farmers. However, a certain level of economies of scale is needed. This means investing in a more efficient curing process that will allow the movement away from coal.

This, nonetheless, would increase the processing cost of farmers. Briones said, if the economics of this cost can be justified, block farming can be a good way to continue farmer’s incomes and the tobacco industry as a whole. Briones said for block farming or land consolidation to work, the government should endeavor to change the country’s laws.

He said presently, the Comprehensive Agrarian Reform Law (Carl), which gave birth to the Comprehensive Agrarian Reform Program (CARP), doesn’t allow land consolidation. The law, passed in 1988, aims to achieve “a more equitable distribution and ownership of land” in the country. Briones believes that land policy should “look not on the bondage to farmers but [land’s] bondage to poverty.”

“If you release them from poverty, whether they cultivate the land or not, that’s better.”

Other sectors

FARM mechanization has always been one of the NTA’s key programs in order to increase farmers’ productivity. From 2018 to 2019, the NTA said it has distributed 26 tractors to tobacco farmers’ cooperatives in Region 1 and Abra.

For the current crop year 2020-2021, the NTA said that it has given 17 units of 4-wheel tractors and 16 power tillers to cooperative-beneficiaries as well as nine solar-powered irrigation systems (SPS-IS) installed in tobacco-producing provinces, servicing 47.38 hectares of area. The NTA said the use of farm machinery is critical in improving farmers’ productivity since tobacco production is labor intensive. The use of tractors and power tillers reduce farmers’ costs at the land preparation level. The loss of farm workers in the agriculture sector in general due to greener pasture in other sectors of economy has also become a burden to tobacco production since labor costs have doubled in recent years. Dy said efforts to modernize the sector are in order. Using fuel tractors rather than pedestrian ones, especially for farms that are proximate to each other would help in land preparation efforts.

Farmers poorest

FILIPINO farmers are among the poorest in the Philippines. According to the Philippine Statistics Authority (PSA), the poverty rate among farmers was at 31.6 percent in 2018. While this is lower than the 40.8 percent poverty rate recorded in 2015, this is still the highest poverty rate recorded in all sectors in the country.

However, Philippine Institute for Development Studies (PIDS) Senior Research Fellow Roehlano M. Briones told the BusinessMirror that for farmers in tobacco-producing provinces, growing the golden leaf offers a way out of poverty.

“It’s a cash crop so even on a smaller land area, pwede pa ring malaki ang kita mo [you can still get a bigger income], especially if you sell one of the higher grade types of tobacco. So up to two [times] to three times more ang income mo sa tobacco compared to rice,” Briones said. “That’s still the case because actually a lot of our high grade tobacco is being exported as well. We actually export numerous types of tobacco and even finished tobacco products.”

Tobacco, as a crop that thrives in dry conditions, is a good alternative for rice farmers. While rice is mainly grown during the wet season, the dry season would see farmers planting other crops, including tobacco. Briones said tobacco offers to increase the income of farmers by 2 to 3 times.

Translating to improvements

DY said growing tobacco has been instrumental in poverty reduction in provinces where the crop is grown. He said the returns in tobacco farming could be around P600 per kilogram on average for Virginia tobacco while for Burley, about P100 per kilo. The NTA data showed that tobacco is grown in 21 provinces nationwide. Virginia tobacco is grown in Ilocos Norte, Ilocos Sur, Abra and La Union in Region 1. The same provinces along with Pangasinan, Isabela, Cagayan, Tarlac, and Occidental Mindoro also grow Burley tobacco.

The NTA said native and/or dark tobacco is grown in Pangasinan, La Union, Cagayan, Isabela, Nueva Vizcaya, Quirinio, Capiz, Iloilo, Cebu, Negros Oriental, Leyte, Zamboanga del Sur, Bukidnon, Misamis Oriental, North Cotabato and Maguindanao.

Galvez-Dacul said based on 2018 estimates and at a support price of P78 per kilo, farmers growing Virginia tobacco could earn around P48,000 per hectare per year to P76,500 per hectare per year since tobacco farmers only plant once a year.

In the areas they visited for their 2018 study, Dacul said those planting native or Burley tobacco alongside rice or corn earn around P45,000 per hectare for two cropping. This means planting tobacco is necessary to keep farmers financially afloat. With this extra income, farmers are able to see some improvement in their lives. This has also translated to improvements in the poverty rates of provinces where they live.

Hard work

PSA data showed that poverty incidence among families in 2018 was in the single-digits in the provinces where a significant amount of Virginia tobacco is being grown. These provinces are Ilocos Sur, Ilocos Norte and La Union.

Based on PSA data, the poverty rate among families in La Union was the lowest at 2.9 percent followed by Ilocos Norte at 3.1 percent and Ilocos Sur at 5.5 percent. “Mababa ang poverty incidence sa tobacco provinces, may implications for that. [Poverty incidence in tobacco provinces remains low; this has implications.] Among the rural regions of the country, Ilocos has one of the lowest poverty incidence. This was 2018,” Dy said. “I have to give it to the hard work, diligence of the Ilocanos.”

Of the three provinces, Ilocos Sur produced the most Virginia tobacco at 20,184.46 metric tons (MT) in 2018. This was followed by La Union at 2,945 MT and Ilocos Norte, 2,931.14 MT. In that year, the country’s total Virginia tobacco production reached 29,788.5 MT. This accounted for 59.13 percent of the 50,381.07 MT total tobacco production of the Philippines. In terms of total tobacco produced in 2018, Ilocos Sur produced the most at 22,153.46 MT followed by Isabela with 9,385.9 MT and La Union with 5,221.3 MT.

“The earnings of farmers from tobacco farming is better than (what they can earn from) palay,” Dy told BusinessMirror. He said to produce five tons of palay per hectare at a farmgate price of P15 would lead to earnings of P75,000 per season.

Ensuring help

DY said tobacco farming is labor-intensive, making it more expensive in terms of inputs but one that leads to higher returns. He said the labor-intensive nature of tobacco farming is one reason cited by some farmers in Mindanao to quit planting the crop.

However, local governments have the ability to help these farmers, given the proceeds from the tax collection that have been earmarked for them. Dy said under this arrangement, farmers and LGUs in the Northern Philippines, specifically Ilocos Sur, have the most to gain since they are the largest producer of Virginia tobacco.

With this, LGUs need to be “creative” to ensure that farmers get the help that they need. This also means continuing to plant tobacco will guarantee the continuation of the flow of these funds to the locales where tobacco is planted. This will also warrant the poverty reduction in these areas. Under RA 7171, Virginia tobacco-producing provinces and municipalities shall receive 15 percent of the total excise tax collected from locally manufactured Virginia-type of cigarettes but the total amount cannot exceed P17 billion as amended by RA 11346. The amount is allocated among Virginia tobacco producing provinces on a prorated basis of their production volume.

Likewise, Burley and native tobacco producing provinces and municipalities receive a 15-percent share of the total excise tax collected, as mandated by RA 10351 or the sin tax law, which is divided among them on a prorated production volume basis. For the 2017 excise tax collections, Virginia tobacco producing LGUs received a total amount of P14.401 billion while burley and native tobacco LGUs would get P3.607 billion, latest DBM data showed.

Yet to release

DESPITE its impact on the lives of farmers, the initial version of the Philippine Development Plan (PDP) 2017-2022 or the Duterte administration’s medium-term socioeconomic plan did not mention tobacco, not even once, in its 296 pages. The government has yet to release an updated version of the PDP as of press time. National Economic and Development Authority (Neda) Regional Development Group OIC-Undersecretary Mercedita A. Sombilla told BusinessMirror that this was mainly because tobacco was already included under the general umbrella of crop diversification efforts.

Based on the PDP, the Duterte administration aims to create “an integrated color-coded agricultural map” that can serve as a production guide on which crops and agricultural activities are suitable in a particular location. This map will take into consideration “climatic types, topography, and socioeconomic conditions.” However, no mention of the specific crops that will be included or if tobacco is included in this effort.

“(Tobacco is) not specifically (mentioned in the PDP). (However, it is) part of strategy to promote crop diversification but there is no particular policy on it,” Sombilla said.

For economists like Briones, this aversion toward including policies that will further the tobacco industry is no longer a surprise, especially with the passage of the sin tax law. Briones said the sin tax law put into perspective Filipino’s priorities, which included health.

Earmarking appropriation

LAWS that prevented tobacco firms from advertising or sponsoring events, Briones said, have significantly affected the tobacco industry compared to the days when laws like the sin tax law did not exist.

“’Nung bata pa ‘ko, meron pang [When I was young, there was the] Marlboro Tour, Tour of Luzon, ironic [isn’t it]? So you can excise the mention of a brand name. [There’re still] cigarette companies sponsoring sports events. That’s how open it was before. But now you don’t see that anymore because they’re all banned, right? So definitely, the development of the domestic market is not a good potential. At a loss ‘yung industry,” Briones said.

Apart from policies that support the tobacco industry, Briones said questions have been raised on the transparency of the use of funds. He said a portion of the funds could be provided to local governments through lump sum amounts which could be difficult to account. Briones said one way to improve transparency in the use of the funds is the policy or earmarking the appropriation of the collection. However, this “earmarking policy” is creating a new problem that perpetuates the health and environmental risks posed by the tobacco industry.

Also limiting

THE World Health Organization (WHO) considered tobacco consumption an epidemic that kills 8 million people every year globally. Over 7 million of these deaths were the result of direct tobacco use while around 1.2 million are the result of non-smokers being exposed to second-hand smoke. The Department of Health (DOH) said there are 40 smoking-related diseases which include lung cancer, chronic obstructive pulmonary disease, heart disease, and stroke. The same diseases are among the top causes of death of Filipinos, according to data from the PSA.

Briones said the stern warnings issued by the WHO and the local departments of health globally are also limiting the growth and development of tobacco in many international markets. Countries in Europe, Indonesia, and China are slowly cutting back on their tobacco consumption. Apart from the health concerns, Briones said there are also environmental risks associated with tobacco. He said the curing process of tobacco still uses coal, which is considered a source of Greenhouse Gas (GHG) emissions.

GHGs are being touted as among the causes of global warming, which triggers extreme weather events such as strong typhoons, prolonged dry spells, and even the rapid pendulum swings between El Niño and La Niña.

“Hindi naman bawal gamitin ang coal, di ba? [Coal use isn’t prohibited, isn’t it?] But nobody in these days of climate change wants to encourage coal unless you’re [a] hardcore coal industry. It’s a kind of industry that you would like to move out of in the long run. In the long run, (the tobacco industry is) not really an industry we want to encourage and promote. It’s going to be like coal. One day, it should be obsolete,” Briones said.

Recent years

THE country’s tobacco exports where the bulk of the local production goes, continues to rise in recent years. Total tobacco exports last year rose by 4.1 percent to 83.152 million kilograms, the highest volume on record. Of the total volume, the bulk were manufactured tobacco products at 48.569 million kilograms while the remaining volume of 34.583 million kilograms were unmanufactured, NTA data showed. Export receipt from total tobacco exports last year grew by 7.71 percent to a record-high $550.488 million with the bulk coming from manufactured products worth $414.066 million. Bonoan said the improved quality of Philippine tobacco has been one of the major factors in the rise of shipments over the years.

But increasing export numbers do not mean a stable market for tobacco, especially since governments and private sectors have been more aggressive in curtailing smoking globally. “Some industry players are saying that tobacco demand may increase due to the development of new generation products like e-cigarettes and heated-tobacco products,” he said. In fact, Bonoan disclosed that local leaf buyers have already committed to purchase 50 million kilograms of tobacco this 2020-2021 crop year.

But if it was up to Briones, using the funds for health needs of tobacco-related diseases would be a much better use of the proceeds of taxes. If there is any more left, Briones said maybe the government can finance research needed for the country’s “export winners” such as bananas or those where the country could gain a competitive advantage such as rubber.

For now, they trust the rice seeds of the grass species Oryza sativa that they’re planting would tide them over. Some would say it’s a misplaced trust as the buying price of palay declined to a 2-year low of P17.85 per kilogram in end-June with the spike in rice imports following the liberalization of the rice trade. Some concede that if only better opportunities exist out there, they would abandon these lands for good. Their hopes to live a bare minimum life, therefore, rest upon tobacco. After all, this town is the country’s tobacco capital. But some would consider this as false hope as the number of tobacco farmers and the land area for tobacco growing have been contracting over the years.

In limbo

DUSK settled on July 25 and Reynaldo Acosta was slumped on a worn gray sofa. His eyes are glued to the live television broadcast of President Rodrigo Duterte leading an entourage on the newly inaugurated bypass road in Candon, 10 kilometers southeast of Acosta’s home in Santa Lucia. The evening news came showing the President signing into law the imposition of higher taxes on tobacco products.

The 55-year-old Acosta never smoked his whole life but the news affected him more than it did a chain-smoker. Another round of sin-tax hikes, another year of lower income, he mumbled as newscasters switched to talking about an actress’s gym workout program.

Acosta has spent over half his life as a farmer supplying tobacco for the country’s biggest tobacco growing and processing company. With the impending implementation of heavier taxes on tobacco items, he is left with two options: to stay or leave town. The latter means abandoning tobacco planting.

Across Acosta’s is Andrea Reyes’s house where the 70-year-old also mulls the future. It’s minutes before midnight but Reyes has just woken up having slept off exhaustion from working the whole day on her farm.

Her house in Banayoyo, a municipality 10 kilometers northeast of Candon, was visited by gloom after learning the news about a tobacco tax hike. Like Acosta, Reyes ran the numbers in her head and sighed: her take-home income from tobacco farming next year will be reduced with higher taxes on smoking products in place. Reyes has been growing tobacco since the company buying their harvest arrived in 1964.

“Up to now, I’m still here,” Andrea said, adding she’s proud of sticking with the tobacco-growing sector through eight presidents. “I tried shifting to other crops, but none can equal the income I’m getting from tobacco farming. It used to be the best source of income here in Ilocos Sur; but things have changed over the past years.”

New law

DUTERTE signed Republic Act (RA) 11346 on July 25, which would further increase the tax slapped on tobacco products starting January 1, 2020.

RA 11346, or the Tobacco Tax Law of 2019, increases the excise tax from the current P35 per pack to P45, or less than a dollar, per pack in 2020. This is followed by a series of P5 hikes until the rate reaches P60 ($1.15) in 2023. By 2024 and every year thereafter, the increase hits 5 percent. RA 11346 did not only raise excise taxes but also put a cap on the share of tobacco-producing provinces from government revenues.

Provinces producing Virginia tobacco would still receive 15 percent of the tobacco excise tax the government collected. However, the share shouldn’t exceed P15 billion. Provinces producing burley and native tobacco would now receive 5 percent instead of 15 percent of government revenues. Their share would be capped at P4 billion.

The Tobacco Tax Law also expanded the programs that local government units (LGUs) of tobacco-producing provinces could fund using their share of the revenues. Under the law, the share in government revenues would be directly remitted to the tobacco-producing provinces.

Total recall

THE head of the National Federation of Tobacco Farmers Associations and Cooperatives (NFTFAC) said the increases in excise taxes would end in lower buying prices.

Bernard R. Vicente, NFTFAC’s president, explained that the reduction in consumption of cigarette would discourage manufacturers from producing more. This, he said, would reduce the volume of tobacco manufacturers buy from farmers.

“Dahil po doon hindi na po kami puwede magtanim ng magtanim at ang bilang po ng hektaryang tatamnaman namin ay mababawasan at ganoon din ang kita po namin every season [We can no longer plant tobacco at the pace we had prior to the signing of the law. Likewise, we have to cut the size of land we allot for farming. At the end of the day, it would negatively impact our income],” Vicente told the BusinessMirror.

Indeed, it is a case of supply and demand economics. When demand for cigarettes declines on higher taxes, manufacturers are compelled to adjust their production downward. As such, they buy less from farmers like Acosta and Reyes for their tobacco leaf requirement.

“We are hit hardest when the government increases taxes on tobacco. We cannot demand for higher buying prices of tobacco leaf because traders and firms will just say demand has gone down,” Reyes said in an interview with the BusinessMirror.

Earner’s woes

DEMAND is just one of manufacturers’ worries; supply is, too. And supply comes from the number of producers, which has been going down.

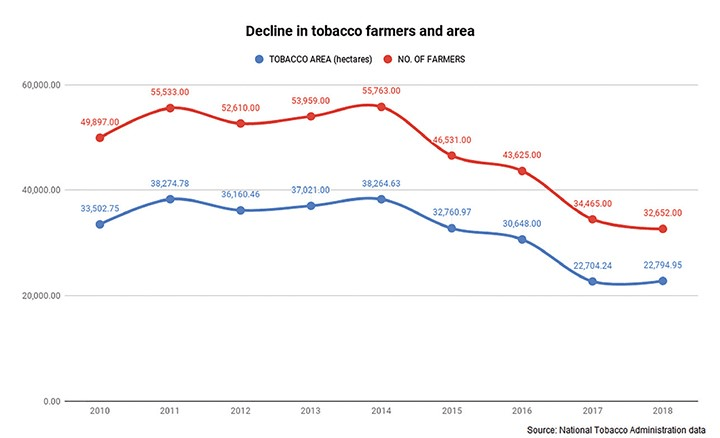

The number of farmers engaged in tobacco planting fell 5.28 percent to 32,652 in 2018, from 34,465 in 2017, records from the National Tobacco Administration (NTA) show.

At the start of the decade, there were some 49,897 tobacco planters in the Philippines. However, as tax hikes were rolled out on tobacco products, the headcount of farmers dropped 4.6 percent steadily every year from 2010 until 2018.

Acosta himself witnessed some of his friends leave the sector for good. He still wrestles with such a decision.

Because for one, he is managing three hectares of land where he cultivates tobacco during the dry season, and, second, how could he turn his back on a valuable memory?

“I was able to send my kids to school using income [from tobacco growing and] my siblings finished their studies with the money they earned from planting tobacco,” Acosta told the BusinessMirror. “We know the value of tobacco. We are used to growing it and I see myself and my family depending on it no matter what.”

For Reyes, she still has lots of mouth to feed and dreams to fulfill. She said she was able to support the education of her three children—one of whom graduated with a double degree—through income from tobacco farming.

The septuagenarian has no plans of calling it quits as she still wants to support her grandchildren.

Growers’ ills

Marcelino N. Biala, executive of the company that buys from farmers like Acosta and Reyes, believes the Tobacco Tax Law has thrown a monkey wrench in the gears of the tobacco industry. Biala knows what he’s talking about: he’s been in the industry for 37 years—22 years for the private sector, 15 years for the government.

“As someone who has been in the heart of the industry for so long, I know the taxes will affect the behavior of our clients. Their purchases will certainly be lesser next year, when the tax hikes are applied,” Biala said. “Of course, the higher the consumer prices, the lower the demand. At the tail of the supply chain, the farmers are sure to suffer.”

Biala is the director for growing operations of a Richmond, Virginia-headquartered multinational firm.

As an executive of a contractor, Biala said it is but expected for tobacco manufacturers to buy less processed leaf from them next year with higher taxes in place.

“It is difficult to explain to farmers why we are buying their produce at lower prices and lesser volume,” he said.

Rising costs

FOR 67-year-old tobacco farmer Ernesto Lacaden Calindas, prices of their tobacco are just one of his worries. Calindas, who has been planting tobacco for 20 years, has seen production costs ever rising, with the scarcity of farm workers as one of the reasons.

He said he’s now paying P350 (nearly $7) per hectare per head since laborers have been scarce. It used to be less than P300 (about $5.73 at current exchange rates). Laborers, he explained, have opted to shift to other sectors such as construction, which offers way higher wages. To note, the legislated minimum daily wage in Ilocos Sur for plantation workers is pegged at P295 (about $5.64) and P282 ($5.39) for non-plantation workers.

Another cost is the shortage in fuelwood, which farmers use in curing or cooking tobacco, Calindas said. He spends around P60,000 ($1,146.25) for his total fuelwood requirement at an estimated current cost of P1,000 ($19.10) per cubic meter.

Calindas estimates the production cost of tobacco right now is at least P130,000 ($2,483.55) per hectare. A farmer should produce at least 1,800 kilograms of tobacco to break even, he added.

Industry decline

DECLINING: this is how government data paints the country’s tobacco industry in terms of output, farmers and area in the past decade. The industry attributed the decline in these three areas to farmers who are aging and who are migrating to higher-income-generating jobs, such as construction work. The industry also blames higher excise taxes.

“We used to produce 160 billion sticks of cigarettes but it went down to 74 billion sticks in 2017,” NTA chief Roberto L. Seares told the BusinessMirror.

The country’s tobacco output declined at a compound annual growth rate of 5.76 percent from 2010 to 2018. Tobacco production in 2018 fell to a decade-low of 43.241 million kilograms, which is 10.25 percent lower than the 48.179 million kilograms recorded in 2017. Tobacco output peaked in 2011 at 79.329 million kilograms, just a year before the Sin Tax Law of 2012 was enacted.

Meanwhile, the area planted with tobacco has declined by an average of 4.19 percent from 2010 to 2018. Total tobacco area last year was estimated at 22,794.95 hectares, which is nearly 32 percent smaller than the 33,502.75 hectares recorded in 2010.

Top buyers

SEARES, however, said the NTA couldn’t “do anything about it [tobacco tax law]. “We just have to support it and help the government,” he said recalling the months-long deliberation on the Tobacco Tax Law.

Still, Seares said the Philippine tobacco industry is still waiting for the fat lady to sing.

He even believes local tobacco output won’t fall any further below 43 million kilograms.

“I don’t think it will go below the 43 million kilograms [we produced last year]. We have high demand for global market and they are demanding about 32 million kilograms,” Seares said.

“[Foreign buyers] love our products due to the taste and aroma. For example, our burley cigarette is very competitive against that of American cigarettes,” he added.

The country’s combined unmanufactured and manufactured tobacco exports in 2018 rose by 36.29 percent to a record high of 79.875 million kilograms from 58.606 million kilograms, NTA data showed.

According to the NTA, the increase was driven by the doubled volume of shipments in manufactured tobacco in 2018, which reached 41.963 million kilograms from 18.476 million kilograms in 2017.

The NTA data also showed that the value of the country’s total tobacco exports grew by 60.04 percent to $511.065 million from $319.337 million in 2017.

Seares said the country’s top buyers are Malaysia, Vietnam, Singapore, Indonesia, the United States and Belgium, among others.

You can’t stop

Aside from the bright export demand, Seares believes higher taxes would fail to dampen local demand for cigarettes but only prompt smokers to shift to cheaper brands.

“Once you start smoking, you cannot stop it,” Seares, a medical doctor by profession, said.

Interestingly, a study by Myrna S. Austria of De La Salle University and Jesson A. Pagaduan of the Asian Development Bank revealed the rise in cigarette prices has resulted in a decrease of smoking intensity, or the amount sticks consumed by a smoker, more than in a decrease in the number of users (smoking prevalence).

“The results show that the increase in excise tax has been effective in reducing cigarette consumption in the country and in making cigarette demand more responsive to price increases,” the authors said.

“Specifically, the tax reform has reduced the number of cigarettes purchased by smokers more than the number of cigarette users,” Austria and Pagaduan added.

The study noted its findings are consistent with previous studies that a “rise in income increases the demand for cigarettes.”

“College graduates are more likely to consume fewer cigarettes; poor households are relatively more responsive to increases in cigarette prices than rich households,” added the study titled “Are Filipino Smokers More Sensitive to Cigarette Prices Due to the Sin Tax Reform Law?: A Difference-in-Difference Analysis.”

Floor prices

Seares is urging tobacco farmers to push for higher floor prices during the tripartite meeting in September. Doing so, he explained, would help them cope with the rising production costs.

He pointed out that the floor prices make the tobacco industry unique and more profitable than other commodities.

“Tobacco is the only commodity with floor prices,” Seares said. “Other commodities have no ensured market resulting in unstable prices.”

The NTA conducts a tripartite conference every two years when new tobacco prices are decided upon. The conference serves as a venue for tobacco farmers and tobacco companies (cigarette manufacturers, tobacco dealers and exporters) to evaluate and negotiate the floor prices of unprocessed tobacco leaves.

Vicente believes that farmers would ask for an increase in floor prices, which is more than what they proposed two years ago.

During the last tripartite negotiations in 2017, farmers insisted on a P16.77 hike across all grades to cope with rising production costs.

Vicente added the rising needs of farmers are behind this push for higher floor prices.

Issues in grades

Calindas also pointed to tobacco buyers as also the reasons farmers are seeing their income decrease.

He said some tobacco buyers are downgrading the quality assessment on their produce. Because of this, Calindas said they are forced to sell their tobacco to “cowboys,” their pejorative term for illegal middle-men, during trading seasons.

He recalled his experience during the last trading season in March when a buyer offered P64 to his best-grade tobacco.

“When a ‘cowboy’ asked me, I told him P77 but we agreed on P75,” Calindas said. He sold his product at that price only to learn later the “cowboy” sold his goods to the buyer he originally approached.

Seares said they have conducted training with traders to harmonize standards and leaf grading. Plus, he added, NTA officials accompany farmers to the trading market when dealing with legitimate traders.

He also encouraged tobacco farmers to complain directly to him if they experience irregularities in leaf grading from legitimate traders.

Vicente said that since the floor prices were increased, unscrupulous buyers tend to downgrade the quality of tobacco sold to them by farmers to avoid paying higher prices.

It’s a perennial problem in the industry, according to Vicente, who added this has forced farmers like Capilas to sell their produce to “cowboys.”

“Sa ibang bansa po ang grader ay galing sa gobyerno upang hindi maging biased. Dapat gobyerno po talaga upang wastong mapatupad ang floor prices [In other countries, the grader is a government representative to avoid biases. It should really be government so that the floor prices could be properly applied],” he said.

Vicente said they have been proposing that instead of private entities only NTA officials or employees grade tobacco produce during trading season to avoid certain biases.

Revenue deprivation

Tobacco industry stakeholders, particularly end-users, have been urging the government to curb the proliferation of illicit cigarette trade in the country.

Stakeholders have also cautioned the government that higher excise taxes on tobacco products would encourage more illicit cigarette trade in the country.

In late June, the tobacco private-sector representatives requested a meeting with the NTA board to discuss illicit cigarette trade.

During the meeting, the private sector disclosed that the amount of seized illicit cigarettes in 2018 doubled to 157 million sticks worth P628 million from 89 million, valued at P356 million, in 2017, according to NTA.

Illicit cigarette brands are sold for as low as P20 per pack to P40 per pack in the domestic market, greatly cheaper than the P51 per pack to P78 per pack of legal brands, the NTA added.

Illicit cigarette trade not only damages business operations of legitimate manufacturers but also deprives the government of revenues, NTA said.

Sound the alarm

VICENTE sounded the alarm that the expansion of programs that could be funded by LGUs through tobacco excise taxes could lessen pro-farmer projects even while the industry is still thriving.

He said they have called the attention of LGUs funding projects like construction of water fountains and covered courts, saying these do not benefit tobacco farmers.

“Ang alam nila tanga kami para magreklamo. Pero sa pangalan namin pinapadaan iyong bilyon-bilyong pondo na hindi naman kami ang nabubusog [They regard us as idiots for complaining but they use billions of funds using the name of the organization],” he said.

Rights Services Inc. (Rights) said it is high time that LGUs included tobacco farmers in their budget process.

Rights noted that doing so would ensure that the “sin” taxes allocated to every tobacco-producing LGU would be used for the benefit of the farmers.

“Allowing tobacco farmers to directly participate in the local budget process is expected to further improve their income and eventually help them shift to healthier and more productive crops,” Rights Program Manager Cynthia Esquillo said in a statement.

The last leaf

CALINDAS considers himself lucky compared to other tobacco farmers.

As a Candon City resident, he receives P15,000 (about $286.98) in cash for every hectare that he plants with tobacco. The assistance comes from the excise-tax share that Candon receives annually from Virginia tobacco production. Candon City also provides tobacco farmers with free farm inputs such as seedlings, fertilizers and insecticides, among others.

He explained that some farmers in other tobacco-producing provinces do not receive any assistance from their LGUs.

“Kung gusto pa nila kaming mag-survive, dapat dagdagan pa nila ’yung assistance sa amin; lalo na ’yung cash assistance—siguro P50,000 para sa kahoy, saka konting gas. Pero hindi pa rin iyon sasapat [If government really wants us to survive, they should increase the assistance to about P50,000 for our fuelwood and gas; albeit these wouldn’t be enough],” Calindas said.

Calindas only learned during the interview, a day after the signing of the law, that excise taxes would increase anew next year.

He went temporarily pale, like having seen a ghost, and glanced at the rice farm behind his house.

“Pinirmahan na talaga? Kung ganyan lang din naman, baka tumigil na ako sa pagto-tobacco [The President signed the law? If that’s the case, I may have to stop planting tobacco],” he said.